Top Columbus Companies that Offer Employee Payroll Giving

Columbus, Ohio, stands out as a vibrant city with a dynamic business…

Top Denver Companies that Offer Employee Payroll Giving

Denver, Colorado, is not only known for its stunning mountain…

Top Indianapolis Companies that Offer Employee Payroll Giving

Indianapolis stands out as a vibrant center for business and…

Top Jacksonville Companies that Offer Employee Payroll Giving

Jacksonville, Florida, stands as a vibrant economic and cultural…

Top San Jose Companies that Offer Employee Payroll Giving

San Jose, located in the heart of Silicon Valley, is not only…

Double the Donation and Firespring Partner to Empower Nonprofits with Automated Matching Gifts Integration

Double the Donation and Firespring are excited to announce their…

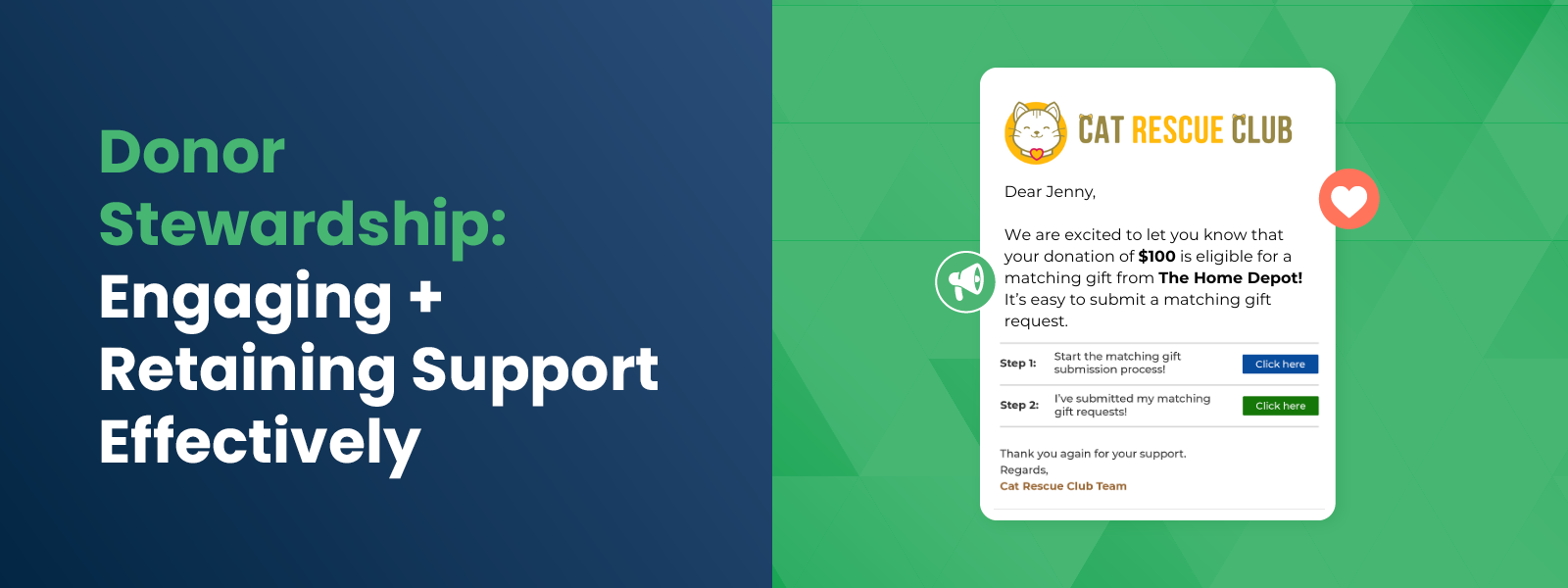

Donor Stewardship: How to Retain Support Effectively

A retention crisis is quietly undermining the hard work of donor…

Capital Campaigns: A Groundbreaking Guide to Success

Every nonprofit organization reaches a point where its vision…

5 Workplace Giving Myths Debunked: Unlocking Hidden Revenue with Employer Data

In my years working alongside fundraising directors, annual giving…

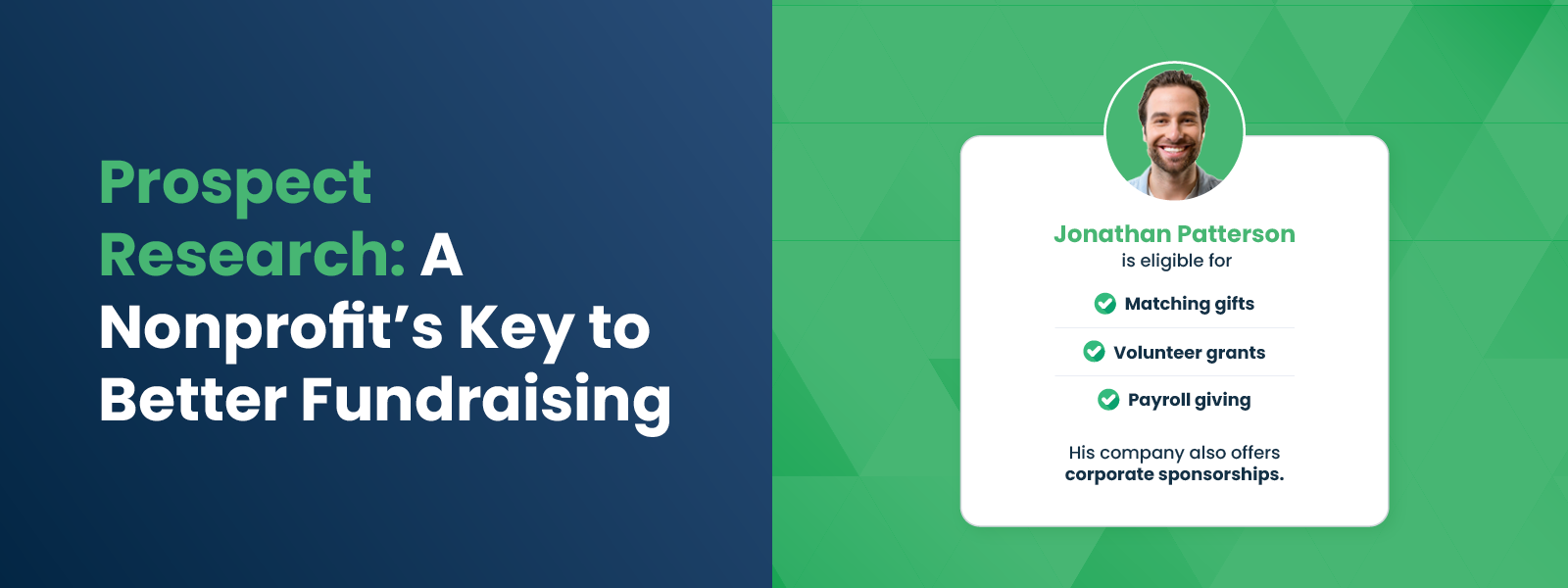

Prospect Research: A Nonprofit’s Key to Better Fundraising

If your nonprofit is looking for a way to maximize its fundraising…