Matching Gift Guidelines | Ratios, Minimums, Maximums & More

Thousands of companies match donations made by employees to a range of nonprofit causes through corporate matching gift programs. However, billions of dollars in available corporate matching revenue go unclaimed each year—largely due to a lack of awareness surrounding the programs and the matching gift guidelines and request process that are required for donors to participate.

A general understanding of corporate giving is a great foundation for maximizing nonprofit revenue. However, in order to succeed in acquiring matching gifts, you’ll need to understand the nitty-gritty elements of program stipulations.

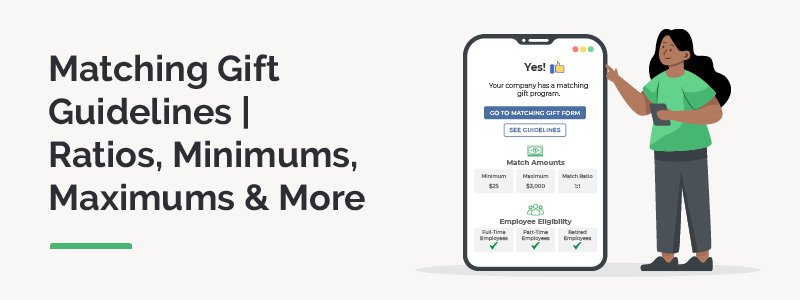

For example, companies are able to decide their specific guidelines for matching gift participation based typically on employee eligibility, nonprofit eligibility, and submission deadlines. From there, the amount that a company will match (per employee per year) is based on a combination of matching gift ratios, minimums, and maximum match amounts.

In this post, we’ll break down the key components of basic matching gift guidelines:

- Match Ratios

- Minimum Match Amounts

- Maximum Match Amounts

- Employee Eligibility

- Nonprofit Eligibility

- Forms and Deadlines

Not to mention, we’ll also provide an overview of the most effective method for determining program eligibility through companies’ matching gift guidelines. Equipped with the right tools, you can easily identify matching gift opportunities and communicate eligibility criteria and next steps to guide donors through the request process.

1. Match Ratios

Companies determine how much to match employee donations based on a preset ratio. In most cases, companies choose to match donations at a dollar-for-dollar rate (otherwise known as a 1:1 ratio).

When a program offers a 1:1 ratio, an employee will donate to an eligible nonprofit, submit their matching gift request to their employer, and then their company will match that gift with the same amount.

For instance, if an employee donates $100 to a nonprofit that’s eligible for the company’s match program, the employer will donate an additional $100. In the end, the nonprofit receives a $200 donation, which is double the original contribution.

Although you can expect to see a lot of 1:1 matching programs, ratios can range from .5:1 (or a $50 corporate donation for a $100 employee gift) all the way up to 4:1 (which would be a $400 company gift in response to a $100 employee contribution). Either way, the nonprofit receiving match funding results in significantly increased amounts flowing to the organization.

Let’s take a look at matching gift ratios in action. Consider these companies, for example:

- Puget Sound Energy matches employee donations at a .5:1 rate.

- Apple matches employee donations at a 1:1 rate.

- Coca-Cola matches employee donations at a 2:1 rate.

Another thing to keep in mind when it comes to matching gift rates is an individual’s employment type. While ratios are typically standardized across all employee types, some companies will vary amounts depending on an employee’s position or type of employment.

For example, part-time employees, retirees, and even team member spouses may have a lower match rate than corporate executives who work for the same company. Take the following companies as an example:

- Soros Fund Management matches donations from partners at a 1:1 rate and employees at a 2:1 rate.

- Johnson & Johnson matches donations from current employees at a 2:1 ratio and retirees at a 1:1 ratio.

Takeaway: Matching gift ratios vary from company to company and may change based on employee position. These stipulations are entirely up to the company, and nonprofits and employees should stay up-to-date on their match opportunities.

2. Minimum Match Amounts

Unfortunately, not every company will match every donation made by an employee—even if they do have a matching gift program in place. In order to qualify for a company match, restrictions are often put in place regarding the minimum donation amount they will match.

If a donor’s contribution falls below that set amount, the company will not match the gift. Keep in mind that this isn’t intended to restrict employees’ philanthropic efforts. Rather, it’s to ensure that employees are requesting matches for causes they truly care about.

Nonetheless, corporate matching gift best practices suggest keeping the minimum low to encourage participation and make the programming accessible to employees of all budget sizes. As a result, some companies will match donations that are as little as $1. However, the most common minimum requirement is $25, with 93% of companies having a minimum match requirement of less than or equal to $50, and the mean minimum amount falling at $34.

Let’s take a look at these companies’ matching gift minimums for a few common examples:

- Apple matches employee donations of $1 or more.

- Harris Corporation matches employee donations as long as they’re greater than $10.

- Home Depot matches donations starting at $25.

- LyondellBasell Industries matches employee donations of $100 or more.

Another thing to note is that, depending on the company, an individual who makes multiple smaller donations within a year may be able to consolidate them into a single donation match request—despite falling beneath their employer’s minimum for any particular gift.

Takeaway: Companies apply minimum matches to ensure that the giving budget goes to nonprofits that employees actually care about. Most often, set minimums are $25, but they range from $1 to $100+.

3. Maximum Match Amounts

In addition to match minimums, companies also put caps on match amounts to ensure there’s enough in the giving budget for each employee to participate. If an employee donates more than the maximum match amount, still, only the defined maximum will be matched by the company.

Maximum matches have quite the range, too. Often, you’ll come across upper limits of between $1,000 and $5,000, with $3,728 as the average maximum threshold. However, there are plenty of companies with matches that are way above that scope.

Take a look at these companies with matching gift caps across the spectrum:

- Avis Budget Group matches donations up to $100 annually per employee.

- General Electric matches donations up to $5,000 annually per employee.

- Merck & Company matches donations up to $30,000 annually per employee.

- Soros Fund Management matches donations up to $100,000 annually per employee.

Regardless, each philanthropic program is generous and has the power to make a major difference in the nonprofit world.

Takeaway: Each company has a different maximum amount it will match. Typically, these are around $1,000 to $15,000, but it’s not uncommon to see caps that are higher or lower than this.

4. Employee Eligibility

Often, companies create eligibility requirements for employees that may depend on their position or another factor.

For example, some companies match donations made by any current employee, regardless of full- versus part-time status. Others will match retired individuals’ donations even after they depart from the business. Others still will even match gifts made by an employee’s spouse.

To get a real-world idea of this concept, take a look at these companies:

- Acuity Brands matches donations from directors and executives only.

- British Petroleum (BP) matches donations made from current employees, but not retirees.

- Sherwin-Williams matches donations made from all current employees and retirees.

- ExxonMobil matches donations made from employees, spouses, surviving spouses, and retirees.

Keep in mind that, as previously mentioned, different positions can sometimes mean different match ratios and maximum match amounts, too. For instance, some companies may allow current employees to donate up to a higher amount than retired employees. Another common case is programs that offer executive employees higher maximums than other employees.

Some companies also choose to further reward employees who go the extra mile. For example, take a look at these programs’ matching gift guidelines:

- American Express offers a 1:1 match ratio for employee donations. However, if the donor serves on a nonprofit board or volunteers more than 50 hours in a year, the first $1,000 of their donations will be matched at a 2:1 ratio.

- RealNetworks offers a standard matching gift program, but if an employee works at the company for 5 years, they receive an additional $500 grant for a nonprofit of their choosing.

Takeaway: In most cases, there aren’t too many requirements employees have to meet to be eligible for matching gifts. However, sometimes, companies adjust program criteria based on employees’ positions.

5. Nonprofit Eligibility

Just like there are standards employees have to meet to request matching gift funds, there are requirements for the nonprofits looking to receive match funding, as well.

While companies typically match donations to most registered 501(c)(3) nonprofits, some companies place restrictions on the types of organizations that are eligible. If a company deems a nonprofit ineligible, employee donations made to that organization will not be matched.

Like all other components of corporate giving programs, the eligibility requirements for nonprofits differ from company to company. These restrictions are often put in place because companies want to support organizations that align with their own views and values while avoiding controversial causes.

For example, churches and other religious organizations are often excluded from matching gift programs. However, many companies will match to religiously affiliated organizations that serve a secular purpose (such as an associated K-12 school or food pantry), while others will match to houses of worship all the same.

Other companies may choose a particular type of organization to which it will exclusively match donations. For example, some businesses match only to educational organizations, while others offer higher maximums or match ratios for schools and higher ed institutions.

Take a look at these companies’ nonprofit eligibility criteria:

- Air Products and Chemicals matches donations made to colleges and universities at a 1:1 ratio up to $5,000, arts and cultural organizations at a 2:1 ratio up to $2,000, and environmental and conservation organizations at a 1:1 ratio up to $1,000.

- ExxonMobil has a maximum match amount of $22,500 for donations made to educational institutions, while it will only match up to $2,000 for donations made to cultural organizations.

- Verizon will match up to $5,000 per employee per year to schools or $1,000 per employee per year to other 501(c)(3) organizations.

Takeaway: Companies sometimes place restrictions on which organizations can receive matching gifts. It’s up to donors and nonprofits to be on the lookout for these eligibility requirements.

6. Forms and Submission Deadlines

Once all requirements of a company’s matching gift program have been met, this is when submission forms and deadlines come into play.

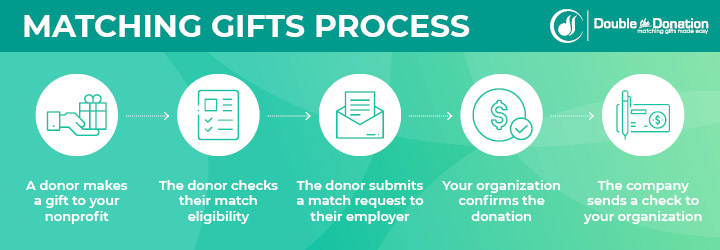

As a quick refresher, here’s how the typical process works:

At this point, we’re coming up on the third step in the above procedure. The donor has previously determined that they’re eligible to participate, and now they’re ready to submit their matching gift request.

Though some companies may still utilize paper request forms, most companies are turning to online portals to manage and process employee requests. The bottom line is that there needs to be a way for employees to submit their match requests and the way in which they expect the request to occur should be outlined within the company’s matching gift guidelines.

Regardless of form type, once the donor has navigated to their company’s matching gift forms, they’ll be prompted to provide basic information for the submission. This typically involves details about themself, the specific gift they made (including donation amount, currency, date of transaction, etc.), and the nonprofit that received the donation (such as the organization name, mailing address, and tax ID number).

In addition to the forms themselves, companies also have to define a specific deadline by which the forms must be submitted. For instance, an employee generally can’t donate to a nonprofit and submit a match request two years later.

Instead, in their guidelines, companies might select a specific annually occurring deadline, accept requests for a specific time period (such as six months or one year) after the individual donation was made, fall in line with the end of the calendar year in which the donation was made, or offer a brief extension beyond the calendar year.

To view a few common types, here are request deadlines for several major companies:

- CarMax accepts matching gift requests within 180 days from the date of the donation.

- Microsoft accepts matching gift requests for donations up to 12 months later.

- Boeing accepts matching gift requests from employees until January 31 of the following year after the donation.

Takeaway: Businesses must create accessible forms and define deadlines before putting a match program in place. Nonprofits and their donors need to be aware of these submission instructions and deadlines, otherwise, they may miss out on matching gifts.

Matching Gift Database: Identifying Companies’ Guidelines

Nonprofits need to stay up-to-date on companies’ matching gift guidelines, such as donation minimums, maximums, ratios, eligibility, and so on—and that’s a lot of information to manage. Unfortunately, gathering companies’ guidelines on your own can be a mundane and time-consuming process.

With a matching gift database (like Double the Donation), the research is streamlined and simplified for nonprofits and donors alike.

This type of innovative technology ensures that your organization has access to thousands of companies’ matching gift program guidelines at your fingertips. As a result, you can easily determine donors’ match eligibility potential and communicate the opportunities to qualifying donors.

Specifically, a matching gift database enables you and your donors to:

- Search for 20,000+ companies’ and subsidiaries’ matching gift programs in seconds

- View and share available information (e.g. forms and requirements) for easy access

- Determine matching gift eligibility and next steps

Think your nonprofit can benefit from this type of tool?

With 360MatchPro by Double the Donation, organizations like yours can even automate the process. From collecting employment data directly within the donation process to quickly determining eligibility and following up via email, no match opportunities will be overlooked.

Matching gift programs have several guidelines that need to be met in order to qualify for participation, all defined by the companies that offer them. As you’ve learned, the most commonly defined elements are the match ratio, minimum and maximum match amounts, employee and nonprofit eligibility, and submission deadlines.

Take all of these factors into account, and equip your team with the tools you need for success, and you’ll be able to effectively increase the funding source for your organization and its mission. Now, get out there and boost your matching gift potential!

Interested in learning more about matching gifts? Check out these additional resources for more corporate giving tips and tricks:

- Corporate Matching Gift Programs: Understanding the Basics. Still have questions about matching gifts? Explore our comprehensive guide to learn more.

- Top 20 Matching Gift Companies: Leaders in Philanthropy. Brush up on the top matching gift companies to see how much your organization could raise.

- Corporate Giving and Matching Gift Statistics [Updated 2022]. Matching gifts might be more prevalent than you think! Understand the opportunity with this research.